The question of where whisk(e)y truly originates has been long debated.

But regardless of whether it was the Scots or the Irish who first distilled the “water of life”, it is undeniable that both nations have a long and proud history of producing the spirit.

Despite its longevity, the Irish Whiskey Industry has a chequered history which has seen many highs and lows.

In the last century, two world wars, trade wars and prohibition, all contributed to a collapse in sales, ultimately bringing the Irish Whiskey Industry to its knees in the 1980s with only two operating distilleries and global sales of approximately only 300,000 cases.

In the wake of this almighty low, the Irish Whiskey Industry was slow to change, seeing out another 30 years with only minimal recovery.

The only way is up.

However, the last decade has brought a wealth of change to the sector. Having started 2010 with only four operating distilleries and sales of approximately five million cases, the industry entered the year 2020 with 38 distilleries and exceeded sales of 12 million cases—a high not seen since the early 1900s.

In addition to putting Irish Whiskey back on the map, this growth provided significant contributions to the Irish economy, with the industry investing a total of €1.55 billion of capital investment in plant and distillery development, contributing €686 million to GDP in 2019, and achieving peak employment levels of 1,640 individuals.

Recovering from a Global Pandemic

The resiliency of the Irish Whiskey sector is undeniable, and it is this resiliency that will see the industry through the lasting consequences of the global pandemic that marred the end of this, otherwise, highly successful 10-year period.

Even as cash flow dried up, visitor centres closed, and jobs were lost, the sector continued to make plans to recoup these losses and continue the growth in key existing markets for Irish Whiskey.

Outlining these plans, William Lavelle, Head of Drinks Ireland, Irish Whiskey Association, made the following statement:

“But our industry intends to win back these sales losses across all our key markets. We are finalising ambitious plans to promote Irish Whiskey in our key markets, from the US and Canada, right back to the domestic market where we’ll be seeking to re-position Irish Whiskey in what is quite likely to be a re-imagined hospitality scene.”

Shortage of Distillery Warehousing

Despite this resiliency, several articles published over the last few years have called into question the ability of the sector to continue meeting the ambitious targets set by the Irish Whiskey Association for the decade ahead.

Pre-covid projections put the industry on target to be achieving sales of 24 million cases by 2030, approximately doubling the size of the sector over the coming decade. However, achieving this target would require Ireland to build additional warehousing to store the maturing spirit; industry experts estimated that, at the time of calculation, the country would need to expand the existing infrastructure to cope with a minimum of 600,000 additional barrels of whiskey.

In 2018 when these concerns reached a peak, veteran whiskey entrepreneur , warned that unless large maturation sites came online within the next two years, industry growth rates would stall.

The issues feeding many of these concerns was the refusal of planning and development permissions for several distillery warehousing sites, and in particular, Westmeath County Councils denial of a planned €138 million whiskey maturation complex in Moyvore.

The reasons cited for these rejected proposals were predominantly related to fire safety concerns and the perception that the maturation sites would blemish the Irish landscape, with one county council going as far as to say that a proposed development at Co Louth would have formed a “discordant and obtrusive feature on the landscape at this location”.

The 100-acre Moyvore site with 12 warehouses was set to provide a total capacity of approximately 200,000 casks and provide much-needed warehousing services to Irish distilleries, large and small alike.

The denial of this project, and others like it, the permission to move ahead called into question the ability of the sector to achieve the planned growth targets but also added to the pressures faced by small and craft distilleries.

As warehousing space becomes scares the distilleries that are reliant on third party storage space bear the brunt of increased competition and rising costs, potentially forcing them out of the market. Alan Wright, the founder of the Moyvore Whiskey Vault, estimated that 60-70% of these distilleries would likely go out of business because of warehouse scarcity.

So where are we now?

Three years on from John Teeling’s ominous predictions, the question of whether the warehousing infrastructure in Ireland can meet the industries long-term growth targets is still at play.

Several of the rejected warehousing projects have since successfully appealed the original decision, however, as a result of these delays, their construction has yet to be completed.

For example, having successfully appealed its rejection in 2019, the Moyvore Whiskey Vault plans to open its first series of bonded warehouses later this year before moving on to complete the rest of the currently planned warehouses by mid-2022.

In the face of this news, it appears as though the industry has secured enough warehousing space to sustain current needs. However, as we move forward into what should be the second decade of growth and revival for Irish Whiskey, the longevity of this reprieve bears consideration.

Exiting the other side of the global pandemic, the industry plans to return to pre-covid highs of 12 million case sales annually before reconsidering the longer-term growth plans for the decade to come.

When figures for these long-term plans are confirmed and compared with the estimated completion dates of the warehouses still to be built, more accurate conclusions on the status of Irish warehousing capacity can be drawn.

Looking to the Future

The growth achieved by Irish Whiskey over the last ten years has demonstrated the true resiliency of the industry, and it is clear that the decade ahead will be one filled with both opportunity and challenge.

As the industry continues to take steps to reclaim its place at the forefront of the global whisk(e)y market and growth targets continue to increase, the need for more warehousing is almost inevitable.

Ensuring that the construction of these maturation sites coincides with the industry’s growth will be a crucial step in safeguarding against the threat of a warehousing shortage. Achieving this balance will require ongoing collaboration between the industry, councils, governments, and locals to assuage all concerns and secure agreements for future developments.

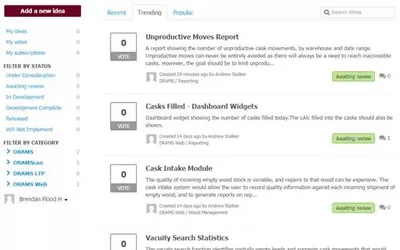

DRAMS is a bulk stock control system used to record the stockholding of all spirit. The inventory management features of DRAMS can be used to provide control over multi-location and multi-warehouse environments where stock – and warehousing – may belong to the holding company or to a third party.

This includes the calculation of rental liability for all stock held in 3rd party warehouses and the production of rental invoices for 3rd party stock stored in warehouses owned by the holding company.

This means that DRAMS is perfect both for operators that rent out warehousing space to third party spirit producers and for producers who store their maturing spirit in third party warehousing.

For more information about the DRAMS inventory management system, download our brochure, or to see how you can optimise your distillery warehouse management, request a demo.