Tequila production, much like other aged spirits, involves a complex interplay of factors, with the maturation process adding layers of intricacy. However, unlike Scotch or Bourbon, Tequila’s production is uniquely tied to the agave plant, which requires approximately seven years to reach maturity. This dependence on agave cultivation adds an additional dimension of complexity when considering a long-term view of tequila production requirements to meet growing consumer demand.

Boom & Bust

Feeding into these challenges, is the propensity for the agave industry to fall foul of a devasting boom and bust cycle. A cycle largely driven by the plants growth period and uncertainty in demand levels over such extended timelines.

The Agave Growth Cycle

Agave plants, particularly the Blue Weber agave used for tequila, take about 6-8 years to mature. This lengthy maturation period requires producers to forecast demand far in advance. Insufficient planting leads to shortages when demand increases, while over-planting results in a surplus when the agave matures, causing prices to drop.

Previous Booms and Busts

Historically, the agave industry has experienced several boom and bust cycles:

Late 1990s Boom: A surge in global interest in tequila led to higher demand and subsequent agave shortages due to previous insufficient plantings, driving prices up.

Early 2000s Bust: High prices incentivised mass planting, and as the agave matured around the same time, a glut occurred, leading to a price drop.

Mid-2010s Boom: Renewed global interest in premium and artisanal tequilas resulted in another period of high demand and rising prices, prompting the industry to plant more agave.

Current Bust (2020s)

The recent boom in the 2010s led to increased planting, but the agave’s long growth cycle means these plants are only now reaching maturity. This has caused an oversupply, further exacerbated by a slowdown in demand for premium tequilas in key markets like the U.S., which had previously driven much of the growth (The Spirits Business) (The Spirits Business) (Drinks Digest).

Market Dynamics

High Initial Prices: When agave is in short supply, prices surge, encouraging producers to plant more.

Delayed Supply Response: The lag between planting and harvesting means that supply adjustments do not immediately balance with demand.

Oversupply and Price Drop: Once the newly planted agave matures, the market often faces an excess, causing prices to plummet.

Recent Developments

Peak Prices and Oversupply: Agave prices recently reached a high of 32 pesos per kilogram due to a spike in demand. However, as the agave planted during this period matures, the market now faces an oversupply, causing prices to drop to about 5 pesos per kilogram (The Spirits Business) (Drinks Digest).

Panic Selling: New growers, who entered the market hoping to capitalise on high prices, are now selling off their agave at lower prices due to the surplus, exacerbating the price decline.

Future Outlook

Industry experts predict that agave prices might not stabilise until around 2026. This ongoing cycle impacts not just prices but also market strategies, with producers considering long-term contracts and diversified planting schedules to mitigate the extremes of the boom and bust cycles (The Spirits Business) (Drinks Digest).

Integrated Inventory and Production Forecasting

Long-term inventory planning is a common practice in mature spirit industries, where extended spirit aging processes increase the complexity of planning. When done effectively, long-term inventory planning provides a detailed perspective on a distillery’s ability to fulfil future demand over an identified planning horizon. Data analysis processes work backwards from forecast demand requirements to identify how the current spirit inventory can be best utilised to fulfil that demand and offer valuable insight into spirit production requirements over that period.

Other insights derived from the planning process often prove invaluable for informing the critical conversations business leaders require to make strategic decisions that drive long-term success and growth for the company.

For tequila producers, long-term inventory management and planning play a crucial role in mitigating the risks associated with agave supply volatility. By integrating detailed spirit inventory data, finished product recipes (bill of materials), and demand forecasts into a long-term planning process, tequila producers can gain a comprehensive understanding of inventory and production requirements over time. This enables them to identify inventory shortfalls, generate monthly plans for distillation, cask filling, and cask dumping, and address issues related to production costs and warehouse capacity as inventory levels change.

Using these insights, tequila producers can extrapolate a detailed view of their agave requirements many years in advance. This foresight enables producers to negotiate more stable and sustainable contracts with agave farmers, fostering a more resilient supply chain.

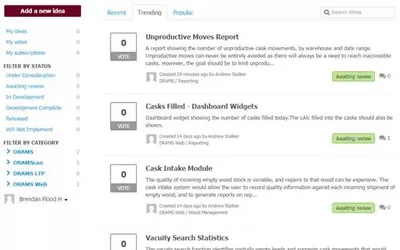

Revolutionising Tequila Production Planning with DRAMS

In response to these industry challenges, the DRAMS Long-Term Planning solution offers an integrated approach to mature spirit inventory management and long-term supply planning. This sophisticated software tool enables tequila producers to effectively align their inventory utilisation with forecasted demand.

The DRAMS Long-Term Planning module operates by consolidating three critical data inputs: current barrel inventory, sales forecasts, and the blend recipes or spirit components of each final product. This integration allows for precise and actionable insights, enabling producers to create multiple projection models within a sandbox environment.

By leveraging advanced data modelling, the DRAMS system provides unparalleled visibility and control over inventory management. It supports the creation of detailed projection models that inform strategic decisions, optimise operational planning, and maintain a balanced production pipeline. This comprehensive approach ensures that distilleries can meet market demands without overproducing or facing shortages.

Adopting advanced planning solutions like DRAMS Long-Term Planning can revolutionise the way tequila producers manage their inventory and production planning. By embracing these tools, producers can sustain long-term growth, and build a more resilient supply chain in an industry where tradition meets innovation.