The global demand for mature spirits has experienced a steady increase over the years. However that doesn’t mean that unforeseen circumstances can result in there being disruptions in the industry and supply chains across the globe, which may result in market uncertainty regarding both supply and demand.

There are, of course, localised examples of spirit production shortages, the result, in many cases, of a combination of external influences and a limited ability to respond to changing market stimulus.

The shortage of premium Japanese Whiskies serves as a prime example. The quality of Japanese Whisky has entered the consciousness of collectors and connoisseurs around the globe; these distilleries now face the challenge of servicing an increase in demand, demonstrating how production capacity decisions made as many as 15 years ago can haunt today’s ability to meet market requirements.

Similarly, the bourbon industry has not been left unscathed; the exponential growth in the global demand for the product compounded by a barrel shortage experienced in 2013 left many in the industry struggling to catch up. Impacting many producers within the industry, a variety of remedial efforts were made to extend product and brand lines including price increases and proof dilution.

Harlen Wheatley, the master distiller at Buffalo Trace, verbalised the challenges experienced during this time by stating that it was a race for supply to catch up with demand even as production levels continue to increase year on year.

While spikes in demand fuel the boom experienced by the spirit sector, it is not always the sole factor in supply shortfalls. Interruptions to the production process are likely to have a more significant influence on the ability to meet future demand.

For example, as the global climate crisis becomes ever more of a concern, its potential impact on one of Scotland’s key industries hasn’t gone unnoticed.

The prolonged heat and extended dry spell experienced in the summer of 2018 meant that even Scotland – known for soggy and temperate summers – experienced drought. As water levels fell so too did the production of Scotch in several distilleries up and down the highlands. The four-week pause in that year saw the production levels in some distilleries fall by as much as 300,000 litres.

The exact consequences of this water shortage in the Scotch industry are unknown and are unlikely to truly be felt for at least another year or so. But while it seems that the Scotch industry came through 2018 relatively unharmed, some environmentalists predict that similar heatwaves could arise every other year by 2050. If this came to pass, it would result in an environment change with significant implications for the Scotch industry.

These individual threats to spirit production are only compounded when the industry begins to consider the long-term implications of the disruptions caused by COVID-19.

With production currently scaled back or halted for many distilleries, and no clear end in sight, it becomes imperative that spirit producers consider the knock-on effects of the global pandemic to the planning and production requirements of the future.

Effective Planning Hinges on a Distillers Responsiveness to Changing Market Demands

Meeting the demand of today and seizing the opportunities of tomorrow is a significant challenge given the inbuilt delay in production caused by that most vital element of the process; barrel maturation. The outputs of today’s distillation efforts must spend years in barrels ageing to perfection before being ready for market.

It is easy to see why the endpoint of a barrel’s journey may be unknown when it is first filled and moved into a warehouse. Product lines change in response to market demands, so spirit destined for one product at initial distillation may find itself used for something else entirely when the warehouse doors are thrown open some years later.

This disconnect between the volume and types of spirits being produced and those that will ultimately be required for blending and bottling makes effective planning extremely difficult. Involving multiple business functions, the intrinsic complexities and high stakes of long-term planning leave little room for error, as the perfect co-ordination of distillation, wood selection, warehousing, blending, bottling and ultimately, distribution must be achieved.

Bridging this gap to ensure the most effective utilisation of each inventory item requires the analysis of three key data points:

- Current spirit inventory

- Forecast demand for each end product

- The spirit composition of those end products

Add to this an innate understanding of the impact of evaporation loss on maturing inventory, and it becomes possible to answer the two most important questions asked of any planner. The first, the volume of spirit required to be produced or purchased to satisfy end-product demands. The second, how inventory position and warehouse capacity will change over time as spirits are produced and consumed.

Making Advancements in Long-Term Planning

Spreadsheets have been a cornerstone of distillery data management and analytics for years, and for many distilleries, they continue to be an essential resource in the analysis of demand forecasts and spirit supply. To those not ‘in the know’, the complex spreadsheets used to support this analysis can seem like an art form mixed with black magic.

Using spreadsheets for this type of complex analysis can be a time-consuming yet ultimately limited approach, over-simplifying the modelling of supply vs demand, while risking costly data entry errors and creating a noticeable skill gap when an experienced staff member departs.

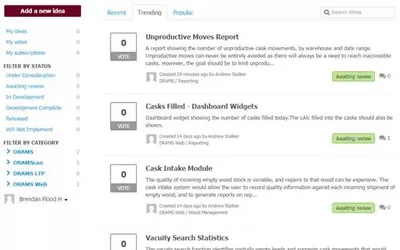

To combat these challenges, distilleries need technology systems which are specifically designed to perform this complex long-term analysis; accurately informing the decisions taken today to safeguard supply years into the future. The DRAMS Long-Term Planning module has been designed to do just that.

Key Benefits of Long-Term Planning with DRAMS

Leveraging the detailed spirit inventory and blend recipe (BOM) data contained within the system, DRAMS Long-Term Planning factors in constraints on production and warehousing capacity to provide a nuanced view of a distillery’s ability to meet future demand. The resulting reports equip the planner with the data – and confidence – needed to make high-stakes decisions, in some cases involving significant capital investment, and potentially altering the course of the business:

- Adapt Production Plans: Understand precisely when and how much of each type of spirit must be produced to become of age exactly as it is required for bottling.

- Adjust Product Recipes: Identify down to the month when inventory levels of a specific spirit type become inadequate to meet bottling requirements and make short-term changes to the product recipe to target spirits in surplus.

- Quantify Purchase Requirements: Accurately identify the number of barrels and volume of third-party spirit required; enter into purchase agreements secure in the knowledge that you are neither under or overstocking.

- Agree Sales Contracts: Identify and sell maturing spirit in surplus to generate revenue and free up much-needed warehouse space; sell future new make spirit to take full advantage of excess production capacity.

- Rent Out Warehouse Space: See exactly how and when warehouse utilisation will change over time, and generate revenue by renting our excess storage capacity.

- Justify Capex Funding: Validate the amount – and timing – of capital investment by identifying the exact point at which spirit production or warehouse capacity will be insufficient to meet future demand.

- Redeploy Marketing Spend: When forecast demand simply cannot be met, change the demand; advise the business to redirect its marketing spend to shift the demand profile towards sustainable end products.

Providing a month-by-month holistic view of changing inventory positions in line with forecast demand, DRAMS long-term planning allows users to effectively manage inventory and plant utilisation across a horizon extending anywhere from 2 to 20 years or more.

Using a sandbox environment to run multiple data models, users can configure and adapt blend recipes and spirit selection rules, applying date effective changes designed to best utilise the available spirit and minimise costs. This flexibility enables users to address scenarios where a recipe will become unsustainable in future years as a result of a shortfall in component spirits.

Conversely, the system also identifies inventory currently in storage without a defined use-case. This spirit will continue to decrease in volume due to evaporation loss while simultaneously attracting warehousing costs. With this spirit identified, the business is then able to consider all possible options for its use, which can include the creation of a new product line or its sale to a third party, both of which would generate additional revenue and free up warehousing space.

When it comes to future production, the detailed insight into future spirit requirements provided by the Long-Term Planning module ensures that users are equipped to adapt production plans to meet future demand. For example, if the system identifies a need for greater volumes of five-year-old spirit seven years from now, the business may choose to begin investing in increased production capacity over the next two years, allowing production to increase in line with requirements.

This correlation between today’s production decisions and the ability of the business to meet far longer-term strategic goals is especially crucial for distilleries looking to incorporate more premium brand lines into their offering. Typically, this premiumisation is contingent on spirit age which means that distillers are required to lengthen the gap between initial spirit production and final bottling, narrowing the window of opportunity to remedy any inventory shortfalls.

Ultimately, DRAMS Long-Term Planning gives the user vastly improved visibility into the effects of changing demand and product lines on maturing inventory position over time, guiding and enabling proactive decision making. As production or storage capacities approach saturation, distilleries are armed with the insights required to support a business case for the commissioning of either new production facilities or warehousing. Alternatively, any periods of underutilisation are also revealed, allowing distillers the opportunity to sell any excess production capacity or warehouse space, consequently maximising all revenue streams.

Request a demo to learn more about the DRAMS Long-Term Planning module and how it can be used to support your future growth plans.